Investment round valuations in Israel rose in 2025, despite geopolitical pressures on the local sector. The AI surge brought IT companies to the forefront of capital raises, alongside Cyber; and the upward trend is expected to continue into 2026, despite underperformance relative to global peers.

2025 outperformed the previous year. Investment round valuations in Israel increased across almost all stages of company growth, with companies raising more capital at each stage. This insight comes from research conducted by S Cube, a firm specializing in high-tech valuations, based on their research of Israeli technology companies and Israel related firms.

However, while valuations in the US reached record highs this year, Israeli tech companies were impacted by the Swords of Iron war and ongoing military activity across the country. As a result, investment rounds in Israel did not set records at any stage of the company lifecycle. The research also indicates that demand for investments in IT & Enterprise Software leveraging AI technologies returned to lead the sector, alongside Cyber. Looking ahead, despite the strong rally in technology stocks, due to massive AI investments by global tech giants, the positive trend in the sector is expected to continue.

Israel Returns to Growth, Yet Underperforms Relative to the Global Tech Sector

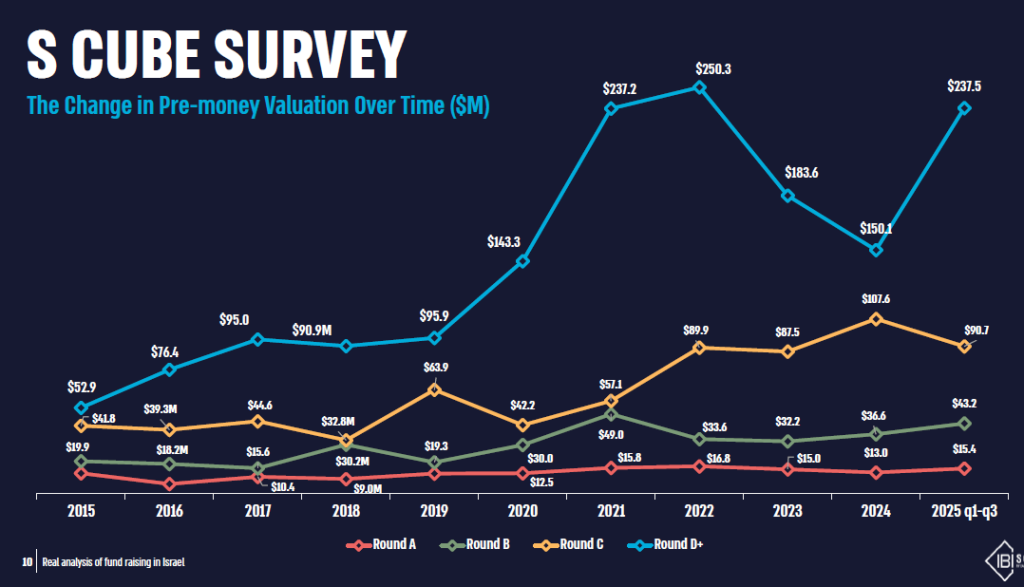

According to our research, which is based on actual data from thousands of valuations conducted by S Cube for its clients since 2013, the local tech sector showed a positive trend despite the war that affected the Israeli economy for most of the past year. Yet, it underperformed relative to US trends. Median independent valuations by investors indicate that late-stage companies (Series D and above) increased in value by approximately 58% compared to the previous year, while Series C companies experienced a decline of about 16% in median valuations. It is worth noting that Series C companies had benefited from the highest valuation growth in 2024, around 23% in median valuation, hence this decline likely reflects a correction from relatively high multiples.

Early-stage capital raises also showed a positive trend, with median valuations increasing by about 18% in Series B rounds, and a similar rate in Seed stage rounds. Additionally, while some 2024 investment rounds offered investors preferential terms, such as warrants or a multiple greater than 1x on the guaranteed return, this trend did not carry over into the past year. These terms have a negative economic impact on company valuations, though due to technical reasons, are not reflected in the reported numbers. In other words, economically, the gap between valuations in the past year and those in 2024 is larger than meets the eye.

Even with the ceasefire in October, the Israeli economy experienced another geopolitically challenging year. Israeli tech companies improved on 2024’s performance, but the record-setting growth in US late-stage rounds did not extend to Israel. Over the first three quarters, US median valuations (Series C and above) rose roughly 58%, reaching $524 million – 13% above the 2021 peak, whereas Israeli late-stage rounds increased by just 3% to $129 million – 30% below the 2022 peak. In mid-stage rounds, US Series B median valuations rose roughly 12%, while Israel saw a slightly higher increase of about 18%. In early-stage rounds, US median valuations surged approximately 25% to a record $53.7 million, compared with a more moderate 18% increase in Israel, reaching $15.4 million – 8% below the 2022 peak.

Historically, Israel’s tech valuation trends have been more moderate than in the US, though they generally move in the same direction. US valuations tend to climb faster during growth periods and drop more sharply in downturns. In 2024, ongoing geopolitical tensions caused Israeli investment valuations to fall, representing a notable divergence from US trends. Fortunately, this pattern did not continue into 2025.

Broad Investment Growth in 2025 Despite Ongoing Challenges

Looking at capital raising volumes in 2025, after three consecutive years of double-digit declines in median investment for late-stage rounds (Series D and above), 2025 saw a roughly 24% increase, with median investments reaching $33 million, an increase from $26.7 million in 2024. Positive trends were also observed at other stages: Series C median investments rose 21% to $25.8 million (from $21.3 million), Series B increased modestly by 3% to $16 million (from $15.5 million), and early-stage rounds grew 17% to $7 million, compared with $6 million the previous year.

The AI Boom Continues, Driving Cyber Demand

The most prominent sector in 2025 investment rounds was IT & Enterprise Software, which is largely based on advanced technologies and platforms, many leveraging AI designed to improve business performance across diverse industries. This sector accounted for roughly 30% of all investment rounds in 2025, moving from second place in 2024 (31%) to the top of the capital raising table. Second was Cyber, accounting for about 25% of rounds, after leading in 2024 with roughly 30%. Third place was shared between Healthcare & Life Sciences – a diverse sector including drug development, medical devices, digital health, and biotechnology, which accounted for roughly 10% of capital raising rounds, a significant decline from 22% in 2024; and Internet Applications, which also account for 10% of investment rounds, which is a significant increase from a negligible 3% in 2024.

Positive Growth Trends Expected to Continue in 2026, with Moderate Growth in Israel

Despite the strong rally in global tech stocks, due to the AI arms race and massive investments from technology giants, we anticipate continued robust growth in the global tech sector in 2026. Key sectors to watch include robotics, which naturally integrates with AI, and Cyber, which is essential to securing these technologies. In addition, Quantum Computing, leveraging quantum physics for complex calculations at unprecedented speeds, is expected to gain prominence. Finally, Defense Tech is likely to stand out due to rising geopolitical tensions across regions including Russia-Ukraine-Europe, Israel-Iran and its proxies, Thailand-Cambodia, and India-Pakistan. Local tech is expected to continue its upward trend, though growth will likely remain more moderate than the global trend.

This article is for informational purposes only and does not constitute “investment advice” or “investment marketing” as defined by the Investment Advice, Investment Marketing, and Portfolio Management Law, 1995, nor does it serve as a substitute for such advice or for legal, financial, tax, economic, or other professional consultation. S-Cube, IBI Group, or any of its affiliates shall not be liable for any loss or damage incurred by third parties based on reliance on the above information.