Who benefits from this investment mechanism? What are the key advantages and risks for entrepreneurs and investors? And what should you be aware of before signing a SAFE? Here are the answers to the most common questions

SAFEs (Simple Agreements for Future Equity) represent an investment mechanism with relatively low legal costs, that are simpler and faster compared to traditional equity financing rounds. They allow entrepreneurs and investors to inject capital into a company without lengthy negotiations, deferring the decisions on complex issues such as company valuation and due diligence, which will be addressed in a future funding round and not necessarily by the SAFE investors themselves. This makes SAFEs an efficient solution for companies needing capital to continue developing their technology that have not yet reached the milestones necessary for a high valuation fundraising round, allowing them to postpone setting a valuation until a more advanced stage.

Investors, in turn, usually receive preferential terms compared to future equity round investors through mechanisms such as a valuation cap and a discounted purchase price, however they also face a relatively high degree of uncertainty, as they transfer the right to negotiate the company’s valuation to future equity round investors. Until a future equity round is completed, SAFE investors remain on “standby”.

What is a SAFE?

A SAFE (Simple Agreement for Future Equity) is a relatively simple investment agreement compared to an equity round. It allows companies to raise capital from investors in exchange for the right to receive shares at a valuation determined later, during a future financing round or exit. The SAFE was designed to replace the need for capital raising through issuing shares, deferring the most challenging issue in the investor-entrepreneur interaction: determining the company’s valuation, or in other words, the equity stake the investor will receive for their investment. SAFEs were first developed by the American venture capital fund Y Combinator, LLC in 2013 as an alternative to convertible notes. Unlike convertible notes, SAFEs do not accrue interest and have no maturity date, making them an attractive alternative for raising capital in early-stage startups. Accordingly, SAFEs are typically used by Seed or Pre-Seed stage companies.

Is a SAFE Safe?

Legally, SAFEs are not an equity investment and are not considered a loan, as they do not accrue interest or specify a repayment date. The purpose of the instrument is to convert the investment into shares in the future, not to return the money like a loan. Under this mechanism, the investor does not immediately acquire ownership of the company’s equity but will receive shares only as part of a future investment agreement or exit, according to the conversion terms defined in the SAFE. However, similar to debt, in terms of seniority, as long as the SAFE has not been converted into shares, it grants investors priority over other shareholders.

Key Terms in the SAFE Mechanism

Valuation Cap – The maximum company valuation at which a SAFE investment will convert into shares during a future equity round is called the valuation cap. This essentially sets a ceiling for conversion to protect SAFE investors in case the company raises capital at a higher valuation than the cap. In this case, the SAFE investment converts into shares based on the cap, granting SAFE investors a higher percentage of equity than if converted at the company valuation determined in the funding round.

Discount Rate – In addition to the cap, most SAFEs provide investors with additional protection through a discount on the company valuation determined in the future financing round. Discounts typically range between 20% to 30%, serving as another layer of protection. The SAFE converts under whichever mechanism, cap or discount, results in a lower implied company valuation, and hence, a higher number of shares for the SAFE investors.

Most-Favored-Nation (MFN) – If a SAFE includes an MFN clause, its purpose is to ensure that SAFE investors are not disadvantaged if the company later signs agreements with new investors at favorable terms. The clause obligates the company to offer SAFE investors the same conditions, such as a lower cap or higher discount, provided to new investors.

Pro-Rata Rights – SAFEs with pro-rata rights give investors the option, but not the obligation, to participate in future funding rounds to maintain their initial ownership percentage in the company.

Key Considerations Before Signing

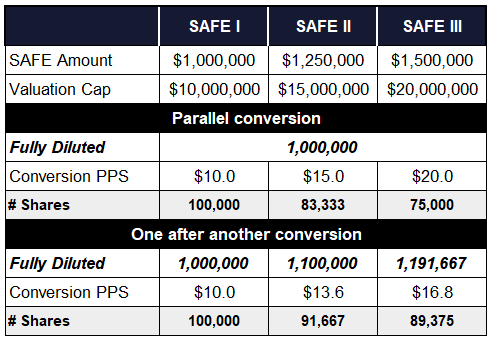

Define a clear hierarchy among different SAFEs – When a company has a single SAFE, conversion in a future financing round is relatively straightforward. However, when multiple SAFEs exist, it is important to clearly define the order of conversion to prevent conflicts between SAFE holders and avoid unnecessary legal proceedings.

Without getting into complex calculations, as shown in the numerical examples above, the conversion order can significantly impact the conversion price per share (PPS) and the ownership stake of different SAFE investors.

If there is a cap, the 409A process is simple – For companies expected to grant stock options to employees subject to 409A, it is advisable to include a realistic valuation cap in the SAFE. Only SAFEs with a cap allow deriving the fair market value of common stock using a relatively simple OPM model, which is a low-cost alternative to traditional valuation methods such as DCF or multiples.

Remember, dilution will occur – If you need fast, cost-efficient funding and believe that your technological breakthrough is imminent, a SAFE may be most suitable. However, it is important to remember that, although shares are not immediately issued, existing shareholders will experience dilution in future rounds. In the next equity round, in addition to dilution from issuing shares to new investors, additional dilution will occur when SAFEs convert according to the defined conversion mechanism.

Uncertainty regarding the extent of dilution – The company valuation at which SAFEs convert will only be determined in a future funding round. Accordingly, the number of shares issued to SAFE investors and the expected dilution for existing shareholders are unknown at the time of signing the agreement.

Bottom Line

If you decide that raising capital through SAFEs is the most suitable path for your startup at this stage, it is recommended to include a valuation cap reflecting a reasonable company valuation from management’s perspective. This allows deriving a fair value for 409A purposes and accounting needs. If there is a significant gap between management’s valuation and investors’ perception, it can be bridged through a discount applied to the future round valuation. In any case, it is important to define a clear hierarchy regarding the order of SAFEs conversions, as even if you sign a single agreement, additional SAFEs may be issued later. Once signed, remember that as long as SAFEs remain unconverted, investors face uncertainty regarding the extent of dilution in the next funding round. It is therefore advisable to include a cap table simulation showing the baseline scenario of SAFEs conversions according to their valuation caps, providing investors with the most reliable indication of their effective current ownership stake.

This article is provided for informational purposes only and does not constitute comprehensive advice regarding SAFEs. It is not legal, financial, tax, or economic advice and should not replace professional counsel. S-Cube, IBI Capital, or any affiliated companies are not responsible for any loss or damage resulting from reliance on this information.