2021 proved that even dreams can be bigger; The rise in mature technology companies’ values encouraged investors to increase risk, and a significant proportion of high-tech employees who hold about 15% of the companies’ capital have become millionaires; Where is the technology sector headed from here?

Although COVID-19 has led to and is still causing severe damage to a tremendous part of the world’s population, the technological revolution, which began even before the virus spread and has received a tremendous boost ever since, led the value of technology companies to soar. Despite the negative momentum in the technology sector since the beginning of 2022, the cheap money is still here, COVID is still here, and the worldwide changes are expected to maintain the technology companies’ high values. According to a study we conducted at S Cube, which specializes in high-tech company valuations, about fundraising by Israeli and Israel affiliated technology companies, money kept flowing in 2021, values continued to skyrocket, and high-tech employees sold investors their options worth billions of dollars. However, the volatility is expected to continue as nowadays it appears to be difficult to achieve an appropriate return on investment in the sector.

The value rising in mature technology companies is encouraging investors to increase risks

If at the beginning of the COVID crisis investors mainly looked for mature technology companies, nowadays, due to the value rises, investors started to raise the risk level and seek the “next thing” – investors increased attendance in B and C rounds.

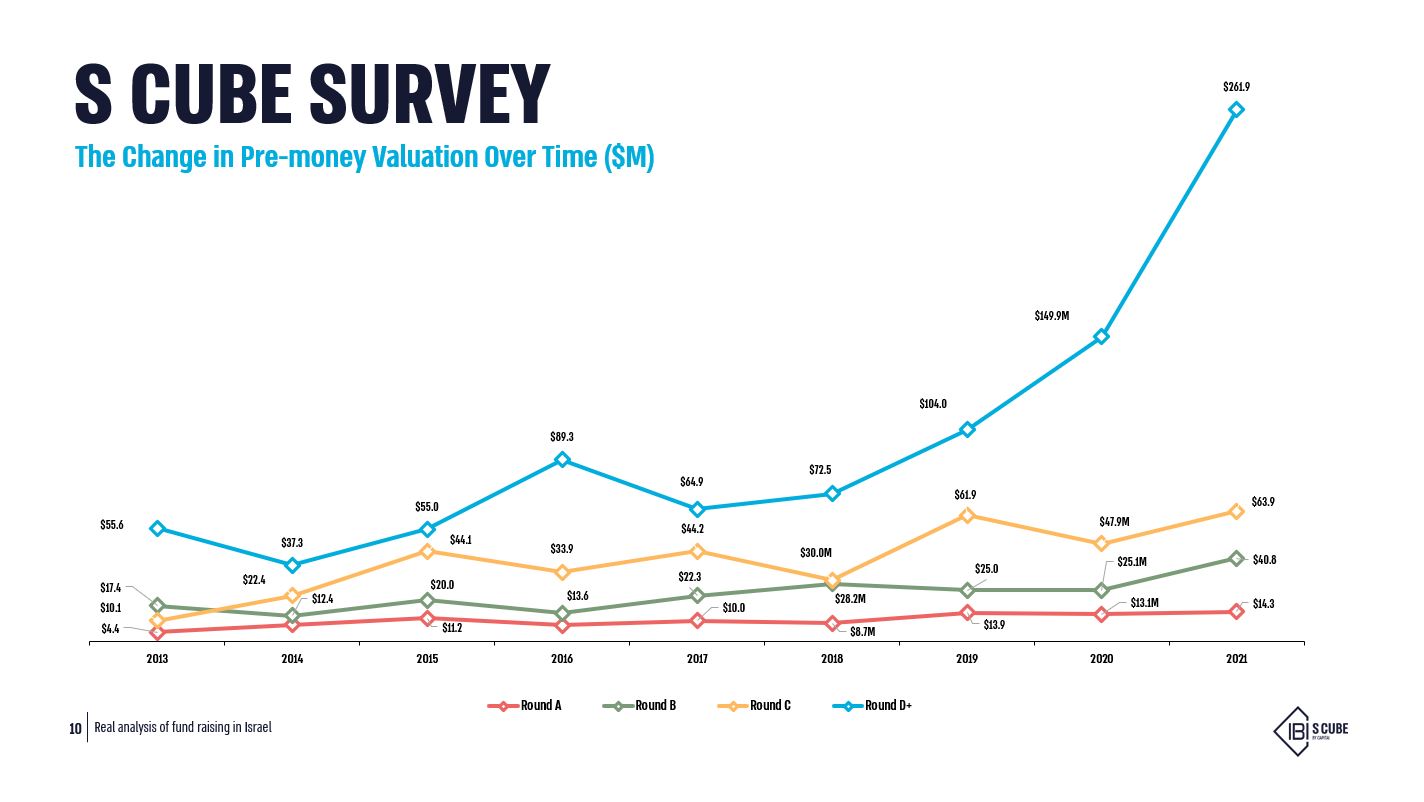

Based on true data from hundreds of valuations performed by S Cube since 2013, there was a jump of about 75% in median values companies received in their advanced funding rounds (D and up) in the past year compared to the year before, compared to a 33% leap in the C round median values, and a jump of about 63% in the B round median values, while in initial rounds of funding there was a slight growth of about 9% in the values given to the companies.

During the past year, a new US president was elected, and the new president took much more significant steps to tackle the COVID-19 crisis. However, President Biden picked up where Trump’s actions left off and printed money massively, which affected the markets, stock markets, and especially the high-tech industry. Due to these actions, we witnessed very high values of IPOs and mergers to SPAC throughout the first half of the year, but they partially halted in the second half of the year. These macro-economic processes affected us all when a big “valuation” premium was given to technology companies.

The technology tide seems to be fueled by phenomena that won’t stop in the near future. Money is cheap, interest rates are low, cash printing continues, and COVID’s direct effects will probably weaken or disappear at some point. If previous crises undoubtedly had a direct cause, at the moment, it is challenging to find a temporary inflator to properly fix the high values, and as a result the markets will probably tumble.

As a result of the leap in values companies received, in terms of the risk-odds ratio, the substantial investments reflect a higher level of risk than in the past. Although the probability that the companies will go into liquidation is relatively low, given the high values the technology sector reached, it seems that it will be difficult to continue to rise from the current point. In this situation, the meaning for the financial market is volatility.

The new millionaires: High-tech employees hold about 15% of the companies’ capital

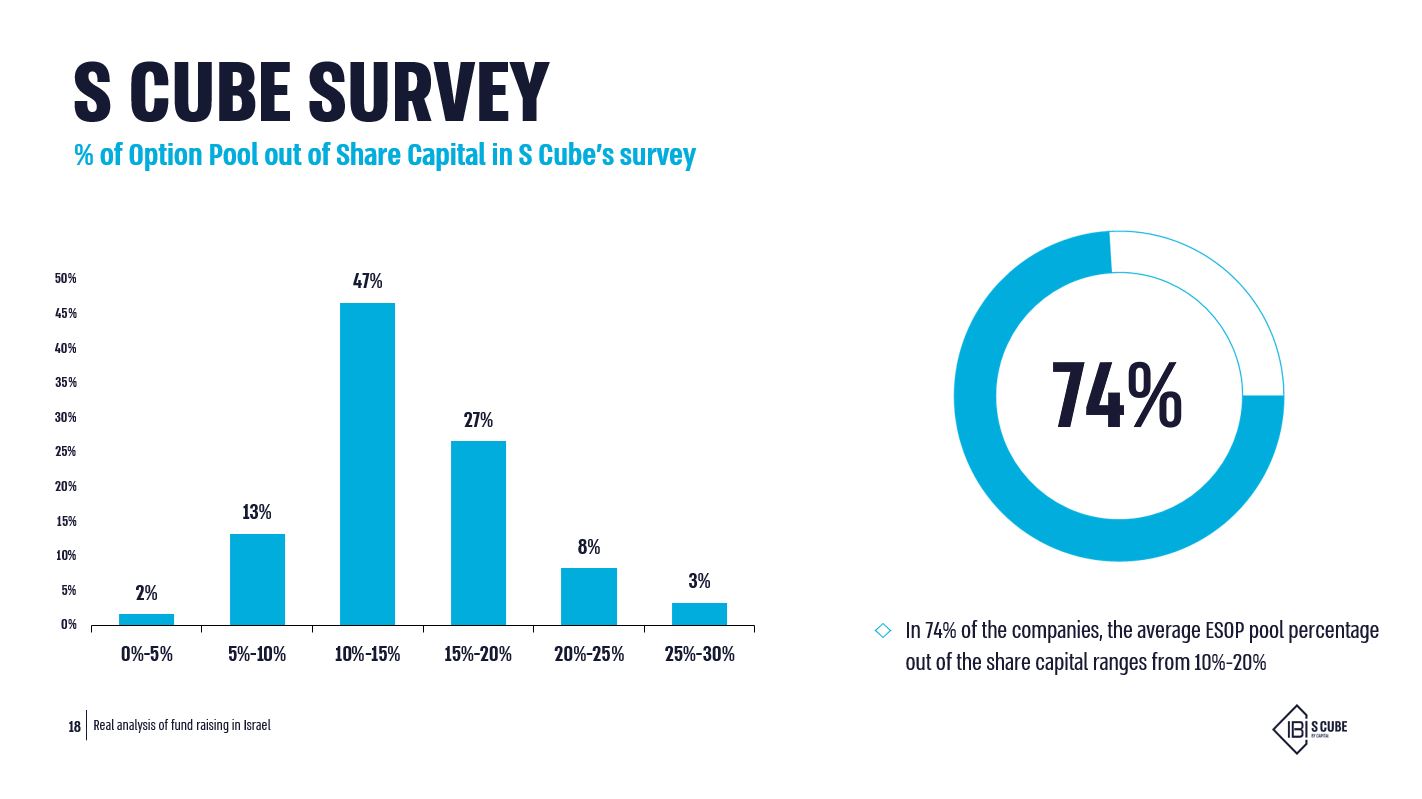

At the same time as the leap in the company valuations, an ancillary phenomenon that has begun to gain ground even more than in the past is the secondary transactions phenomenon, which has made a large part of Israeli high-tech employees millionaires. To estimate the size of the capital held by high-tech employees in Israel, S Cube’s study findings showed that in 2021, about 75% of companies allocated 10%-20% of the capital to grant employee stock options.

Recently, unprecedented Israeli secondary transactions were made, while during the past few months S Cube client’s secondary deals alone are estimated at over 2 billion dollars.

The value you get on Wall Street is still higher

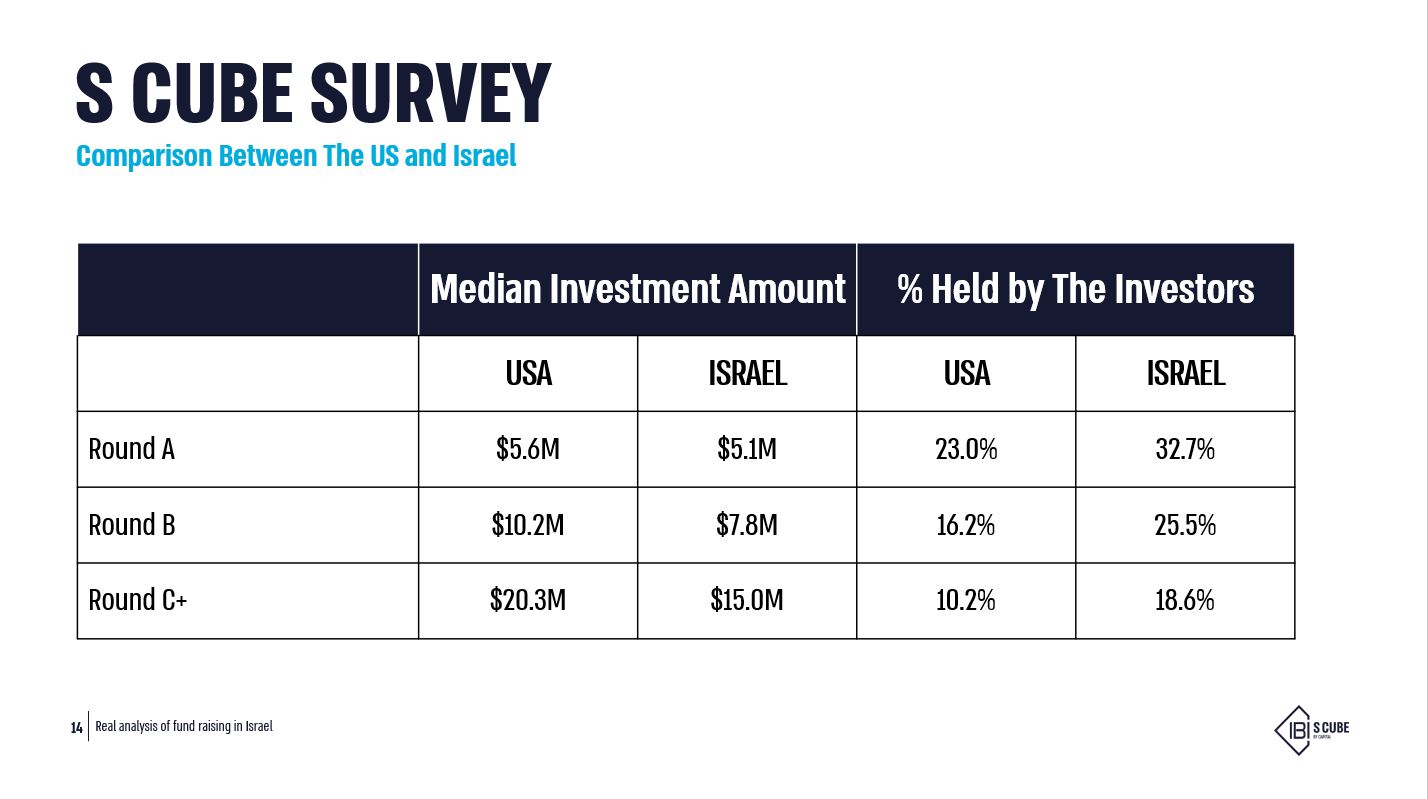

Although the gap between the United States and Israel has narrowed over the past year, the valuations that companies receive in the US are still significantly higher than in Israel. In 2021, the median investment amount in Israel for receiving about 1% of a mature company’s capital, in rounds C and up, was about $800,000, compared to about $2 million paid in the US – a difference of about 150% – compared to a gap of about 175% recorded in the previous year.

On the other hand, in the initial funding rounds, the gaps widened. Thus, the median price offered for 1% of the companies’ capital in their A funding round in Israel was about $155,000, compared to about $244,000 in the US – a gap of about 56%, compared to a 43% gap in the previous year.

Similarly, the median price offered for 1% of the companies’ capital in B rounds in Israel was about $300,000, compared to about $630,000 in the US – a gap of about 106%, compared to a gap of about 94% in the previous year.

Want to hear more? On March 16th we will reveal S Cube’s research findings for 2021 as part of the annual event with Meitar Law Offices. We will present 2021 high-tech fundraising trends in relation to the American market, and provide forecasts for the first half of 2022.