How does the option distribution process work? What is the ideal number of options to assign to employees? What is the vesting period? How can you meet the money before the exit? S Cube is here to answer all your questions

One of the most significant challenges start-up companies face, which sometimes precedes product development or fundraising, is how to incentivize employees in the best way for the company. On the one hand, the company is operating on borrowed time – until the next funding round. On the other hand, the company’s survival and success depends first and foremost on human capital, its quality, perseverance, and desire to lead it forward towards the exit. So how can you have your cake and it eat it too?

Option allocation is the answer. Along with other terms of employment in technology companies, the company will have to offer a capital incentive in order to recruit and retain employees, especially those who can be defined as “Talents”. Not only will the option allocation make new and existing employees think like owners (since they indeed become owners), the company may be able to increase the cash investment volume in activities such as developing additional app features, bug fixing, investing in design, improving user experience, sales, and marketing. All these may generate revenue and ultimately profit.

How does the employee stock option allocation mechanism work?

Employee Stock Options (ESOs) give the holder (employee) the option to purchase a certain number of shares at a certain price defined in advance by the company (the exercise price). The lower the exercise price (as compared to the share price), the higher the option value. ESOs are more common in the high-tech field than in other industries. In these companies, options are translated into real money mainly following an “exit”, company selling, public issuing, or another deal that is gaining ground – Secondary deals. ESOs have an expiration date and are revoked if not exercised into shares during their contractual term, which is usually seven or ten years from the grant date.

While distributing ESOs the company is not required to utilize its cash flow, and in case of company success, the employees typically receive the right to participate in the capital success. That is, if there is an exit, employees who have not yet been required to invest any amount in buying shares, will be able to exercise their stock options, sell them, and maybe be left with a hefty amount in their pocket.

As a matter of fact, in a successful scenario, the company “pays” the employee an amount from tens to hundreds of thousands of dollars, without investing a cent and deferring the payment to “if and when” there will be more than enough money to give everyone generously.

ESOP Pool

The Employee Stock Ownership Plan Pool is intended for the purpose of granting options to employees and is usually created by companies in a new funding round, when in every additional round the option pool is slightly increased to maintain a certain percentage of the company’s capital as an incentive for employees. However, many companies are undecided about the desired pool size. What is the “correct” capital rate that should be allocated to the company’s employees? 10%? 20%? The truth is that there is no unequivocal answer, but according to the wisdom of the crowd, it is probably about 15%.

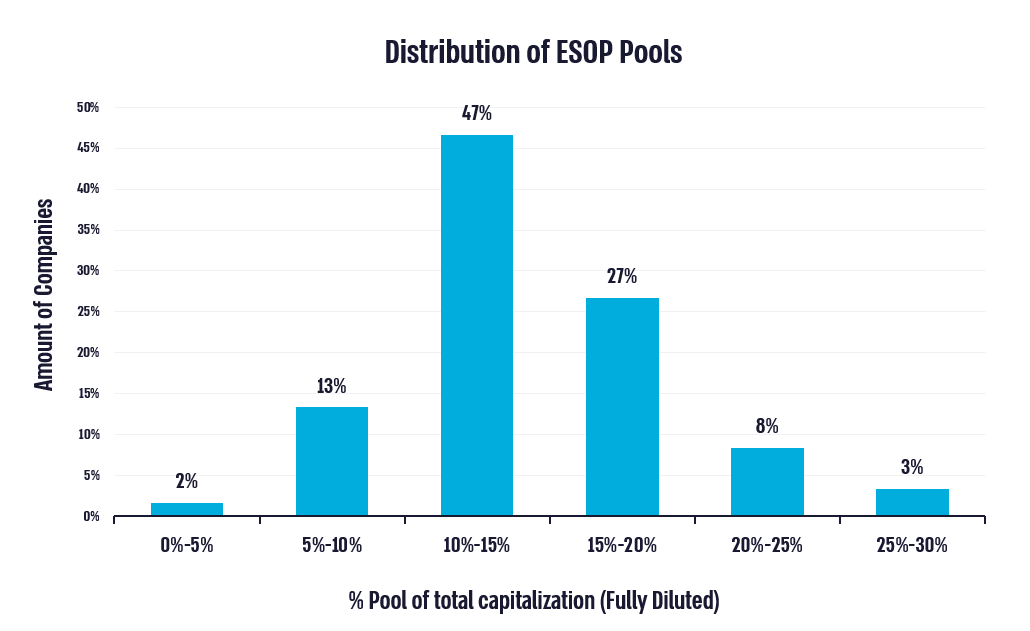

S Cube performs about 60% of the Israeli high-tech valuations. Our annual study showed that in 2021 funding rounds, the Israeli high-tech companies’ average stock was about 15% of the company’s capital (fully diluted), and the current option pool of the vast majority of companies (approximately 73% of the option pools) are in the range of 10%-20%, which is demonstrated in the following chart.

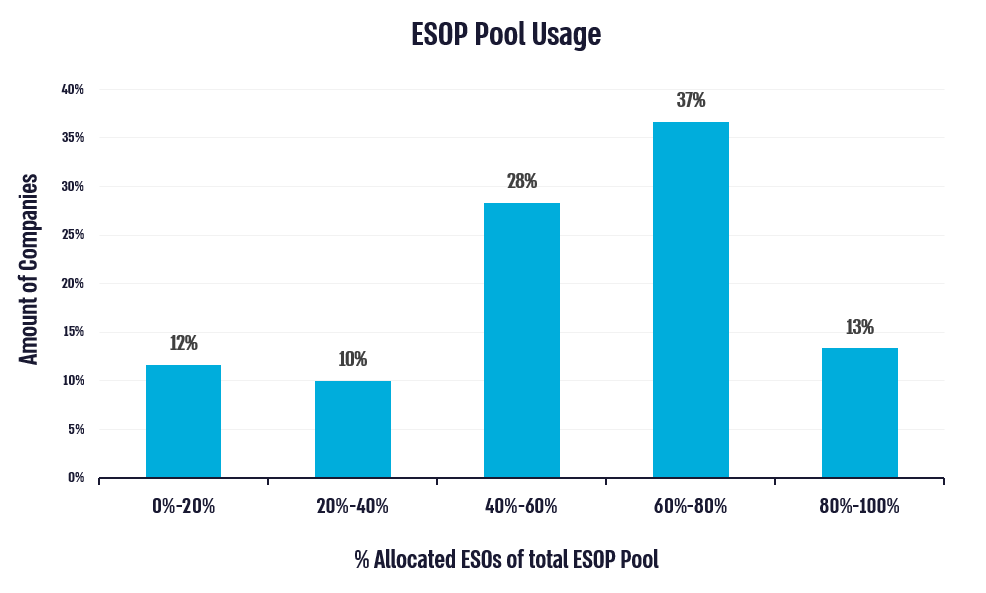

Our study also found that the option pool utilization rate, i.e., the percentage of options that were granted or promised to employees, averaged about 65%, while the utilization rate of the vast majority of option pools (about 65% of the databases) was in the range of 40%-80%, which is demonstrated in the following chart.

Wise allocation planning and management in advance may lead to future benefits

Although granting option does not involve any cash flow expense (except for non-material ancillary costs, such as external consulting fees, etc.), from an accounting point of view, according to the accepted accounting guidelines, this is an expense recorded in the company’s books. Regarding this matter, it is worth taking into account that an option valuation is required for the purpose of recording the expenses in the books, so the more complex the options mechanisms, the more complex the valuation, and accordingly, the options maintenance will be more expensive.

Assume that the employees don’t really understand what they have in hand

While the vast majority of companies are non-transparent towards employees regarding the value of their options, it is important that employees understand the economic significance of the options granted to them so that they also understand exactly what they might lose if they decide to leave the company. For this purpose, it is recommended to provide them with the required information and even arrange trainings by professional bodies.

According to a *study conducted by Dr. Yifat Aran of Haifa University, and Dr. Raviv Marciano-Gurof of Boston University, regarding US high-tech employees’ options, it was found that less than 20% of employees are aware that investors have excess rights over ordinary shareholders. In addition, they found that less than 40% of employees understand that the higher the exercise price, the lower the option value. Most employees do not fully understand the economic meaning when it comes to options, which are supposed to incentivize them to stay in the company.

Why not take the options and run?

Anyone looking for a loophole probably imagines how a moment after receiving the options, the employee is already in the race to find the next start-up that will be willing to give them options just by signing a contract, but that is exactly what the vesting schedule is for.

When granting employee options, there are two elements made to encourage the employee to stay in their position over time: First, it is not possible to exercise the options until the vesting date. Usually, the number of options granted to an employee are divided into tranches, which are vested over 4 years, with the first tranche – 25% – vesting one year from the grant date and then every quarter another amount vests which accumulates to 25% each year.

Second, even after the options have fully vested, i.e., when they are exercisable, an employee who decides to leave the company (or if the company ends his employment) will usually receive a 90-day window to exercise the stock options. After this period, the options will expire and can no longer be exercised.

Thus shall it be done to the employee whom the board delights to honor

Another alternative for option holders to meet the money, which has been gaining momentum recently, is secondary transactions. The secondary deals volume is growing rapidly in start-up companies in Israel. Recently, secondary transactions were carried out in Israel on an unprecedented scale, while recent secondary transactions carried out only among S Cube customers were estimated at more than two billion dollars.

This type of transaction usually allows senior and long-term employees to sell about 10% of their vested options. The options are exercised for existing shares that are purchased from the company’s employees, different from a “regular” transaction, when new shares are allotted and money is given to the company in return.

Secondary transactions have many benefits, including the ability to exercise options before an exit. This type of transaction allows the founders, senior executives and sometimes even regular employees to “meet” the money, or part of it, at an early stage without diluting the remaining investors – this is because the secondary funds receive their shares from existing shareholders. Along with many benefits, secondary transactions may entail significant tax implications, such as capital gain vs ordinary income. To avoid this, it is advisable to consult with professional bodies before signing the agreements, since after signing, the issue becomes much more complex.

*Aran, Yifat and Murciano-Goroff, Raviv, Equity Illusions (August 2, 2021).