The performance of the domestic sector was good relative to the US, despite unprecedented geopolitical crises; the medical and cyber sectors have eaten into the market share of information technology companies; and a change for the better is expected at the end of the second half of 2024

In 2023, the local technology sector exhibited resilience amidst challenges faced by foreign investors, garnering renewed confidence. However, the deep global tech crisis also impacted Israeli tech firms, compounding the economic damage from what proved to be one of Israel’s most difficult years. New research from S Cube, which specializes in the valuation of high-tech companies, sheds light on the capital-raising landscape for Israeli tech firms and those affiliated. Despite a notable reduction in overall investment, top-tier companies defied odds by increasing their median investment volume compared to last year. Furthermore, the fields that received the highest number of fundraising rounds last year remained the same as last year, when the demand for investments in the fields of medicine and cyber ate into the market share of information technology companies.

Despite the national trauma, Israeli high-tech remains strong

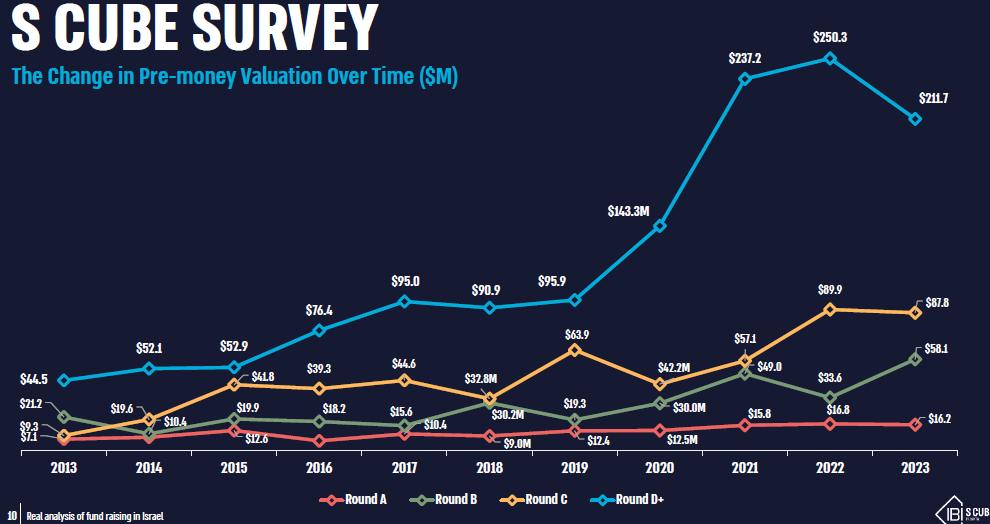

Based on extensive data from thousands of valuations conducted by S Cube for its clients since 2013, the study identifies the magnitude of the impacts of geopolitical events on the Israeli economy and the prevailing crisis within the global tech sector over the past year. This translated into a notable decline in the frequency of fundraising rounds. Among the rounds that did occur, there was an approximate 15% decrease in the median valuation of companies in the more advanced fundraising tiers (D and above) compared to the previous year, alongside a marginal 2% dip in median valuation for companies raising C rounds. However, fundraising rounds for companies in their initial stages displayed a mixed pattern: a remarkable 73% surge in the median valuation for B rounds contrasted with a slight 4% decrease in valuations for A rounds. This variance suggests a discerning approach by investors, shown by a 40% reduction in the number of B rounds. Investors appear to favor companies demonstrating early-stage promise and significant growth potential, contributing to the increased valuations observed in certain fundraising tiers.

Regarding the challenging economic climate faced by Israel, especially within the technology sector, Israeli tech companies demonstrated relatively robust performance compared to their US counterparts. In the first three quarters of 2023, the US witnessed a substantial 54% decline in median valuations for companies in advanced fundraising stages (C rounds and above), whereas Israel experienced a more modest 24% decrease in the same category. Similarly, while the US saw a significant 66% decline in median valuation for B rounds, Israel saw a noteworthy 73% increase. In the initial stages of fundraising, the US experienced a 9% decrease compared to Israel’s 4% decline. It’s important to note that during peak periods, Israel’s value escalations were more tempered, and historically, the impact of crises on Israel’s tech sector performance has been less severe than that on US companies.

The leading companies managed to increase the investment amounts

Analyzing last year’s investment rounds reveals a surprisingly positive trend in advanced stages (D and above), with a notable 4% uptick in median investment volume received by companies, reaching approximately $42.7 million compared to $41 million the previous year. This figure stands only 15% less than the median investment volume recorded in 2021, which hovered around $50 million – in a year often characterized as a bubble. While this phenomenon isn’t representative of the entire sector’s performance over the past year, it underscores a fundamental truth: promising companies continue advancing even amidst crisis. Conversely, the broader sector trended negatively in terms of investment volumes, witnessing a 63% decline in median investment volume for C rounds to approximately $10 million, compared to roughly $27 million in the previous year. Similarly, there was a 36% dip in median investment volume for B rounds, totaling about $8.3 million compared to $13 million in the prior year, alongside a slight 3% decrease in median investment volume for initial fundraising rounds to approximately $7 million, down from about $7.2 million the preceding year.

The fields of medicine and cyber have taken a bite out of information technology’s market share

Amidst the upheaval, the momentum of the technological revolution remains unabated. The demand for technology continues to increase across industries. The key sectors dominating the landscape in the past year remained largely the same. Leading the pack once again in 2023 were IT & Enterprise Software ventures, constituting roughly 24.6% of all investment rounds – a decline from the previous year’s 33.3%. This category encompasses technologies leveraging artificial intelligence to enhance the operational efficiency of businesses across different sectors. Following closely behind, Healthcare and Life Sciences secured a notable share, accounting for approximately 20.3% of rounds compared to 17% the preceding year. This sector spans a spectrum of fields including pharmaceuticals, medical devices, digital health, and biotechnology. Notably, Cybersecurity witnessed a resurgence in interest, rebounding to approximately 19% of investment rounds last year after experiencing a dip to 14% in 2022.

A change for the better is expected at the end of the second half of 2024

In 2024, the United States enters an election year, a period often marked by a conservative approach from investors who tend to prefer less risk until after the early November elections. However, historical trends suggest that the stock market typically rallies post-election, regardless of who wins. Consequently, while the current crisis is anticipated to persist through 2024, optimism prevails for an upturn in the latter half of the year. Israeli high-tech remains intertwined with the fluctuations of the American market, although the immediate future is dictated most significantly by the duration and outcome of the ongoing conflict.

What is said in this article is provided for informational and general purposes only. The aforementioned does not constitute “investment consulting” and/or “investment marketing” as defined in the Law on the Regulation of the Practice of Investment Consulting, Investment Marketing and Investment Portfolio Management, 1995 and/or a substitute for the above and/or a substitute for legal, financial, taxation advice, financial or any professional and personal advice. The S-CUBE company and/or the IBI group and/or any of the group companies will not be responsible for any loss or damage caused to any third party due to reliance on the above information.